Pay as you earn in construction PAYE

The Pay as you Earn scheme, or more familiarly, PAYE, is the means by which HM Revenue and Customs (HMRC) deduct tax and National Insurance contributions from employees.

Any person, whether an individual or company, who employs someone under a contract of employment is obliged to operate a PAYE scheme and then deduct tax and national insurance before passing those deductions to HMRC.

It is important for potential employers to have a full understanding of these rules and to ensure that they are applied correctly. In particular it is necessary to understand the meaning of “employee” so that PAYE is applied only to those individuals who can be so categorised.

For construction industry employers the application of PAYE has added complexity as the requirements of IR 35 and the Construction Industry Scheme have a direct bearing on the applicability of PAYE in particular cases.

Administering PAYE can be a time-consuming process for employers with a variety of reporting requirements and deadlines to be met. For this reason many small employers prefer to outsource the administration of the scheme to external service providers who undertake full payroll and reporting obligations via the use of proprietary software.

For more details visit HMRC: PAYE

[edit] Related articles on Designing Buildings

- Capital gains tax.

- Construction industry scheme.

- Construction Industry Scheme or IR35?

- Construction recruitment agency.

- Court of appeal ruling on holiday pay and employment status.

- Employee.

- Hourly rate.

- Human resource management in construction.

- IR35.

- IR35: essential steps for compliance.

- Limited appointment.

- National insurance.

- Payroll companies.

- Status determination statement SDS.

- Tax relief.

- Umbrella companies.

- Tax.

- VAT.

[edit] External references

Featured articles and news

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

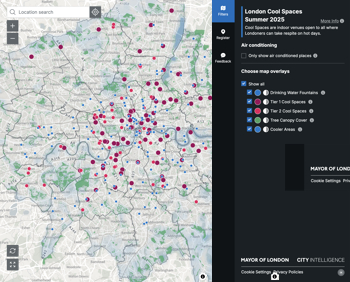

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).